Contract awards on major regeneration and infrastructure projects have seen ‘hotspot’ pockets of construction emerge across Great Britain as investment in housebuilding, infrastructure and commercial shifts away from London and the South East.

The ‘Regional Construction Hotspots in Great Britain 2017’ report from industry analysts Barbour ABI and the Construction Products Association, highlights the levels of construction contract values awarded in 2016 across all regions of Great Britain, with the majority of the work taking place in 2017 onwards. A number of districts are experiencing unprecedented growth; however regionally only Scotland and the West Midlands saw any total annual growth in construction value.

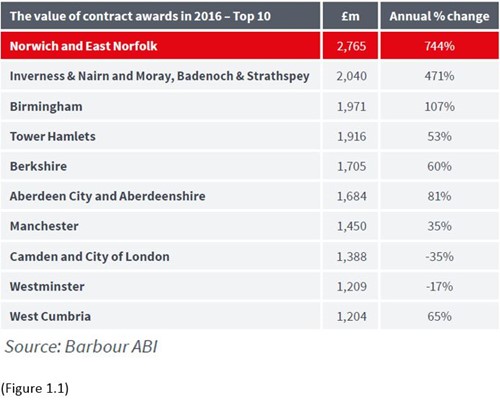

Norwich and East Norfolk led all districts across the UK in 2016 (see Figure 1.1), with more than £2.7 billion worth of construction contracts, helped greatly by the year’s largest contract award, the £1.8 billion East Anglia ONE offshore wind farm. Only two London regions made it into the top ten – Tower Hamlets and Camden and City of London, fourth and eighth respectively.

The report compared regional construction contract values in 2016 against the average of the last four years, resulting in ‘hotspots’ and ‘coldspots’ for last year’s commissioned projects in the residential, commercial and infrastructure sectors.

Hotspots

In past years, London dominated the ‘hotspot’ pockets of construction activity, however the report for 2016 indicates a spread across Great Britain, with London only holding six of the 61 hotspots. Scotland was the leading region with nine hotspots after doubling its contracts awarded value for infrastructure to £3.8 billion.

Birmingham was the only UK region that experienced a combined ‘hotspot’ for commercial, residential and infrastructure construction contract values last year when compared to 2015. This was primarily driven by the award of contracts for the regeneration of the city centre, including a combined 1,500 flats at the Connaught Square and Exchange Square redevelopments and high-profile new office space at Paradise Circus, Arena Central and Snowhill.

Coldspots

The majority of the coldspots are clustered in the residential sector and replicated across the country, as contract award values fell from the highs registered in 2015, falling below long-term averages.

In the South East, Yorkshire & Humber and the East Midlands, one-third of sub-regions were residential coldspots. Of the 42 coldspots across Great Britain, the South East led all regions with seven of the total, all for residential. London was actually the sole region where there were no residential coldspots, with contract awards for large developments keeping values relatively unchanged from 2014 and 2015.

Commenting on the figures, Michael Dall, Lead Economist at Barbour ABI, said: “The Government is focused on raising the levels of major infrastructure projects, in particular public sector schemes such as offshore wind farms, energy plants and motorway upgrades have considerably boosted construction value in more rural regions. Districts such as the Isle of Anglesey and Norwich and East Norfolk have experienced year-on-year construction contract value growth of 916 per cent and 744 per cent respectively.”

Rebecca Larkin, Senior Economist at the Construction Products Association commented; “Coldspots permeated through the residential sector last year, in a marked contrast to its strength in the previous regional report. The sector has ramped up house building activity over the last 12 months, reflecting the flow of work generated by the peak in contract awards in 2015, but there are now question marks as to what impact the fall in contract values will have on construction over the next 12 months. Monitoring contract value in 2017 will give an early indication of the sector’s near-term performance.”

View the Regional Hotspots in Great Britain 2017 report here.

-ENDS-

Notes to editors:

Press enquiries to:

Jonathan Touhey at Barbour ABI

Tel: 0151 353 3605

Mobile: 07976 837339

E-mail: jonathan.touhey@barbour-abi.com

Emma Salmon, CPA Marketing and Communications Executive

Tel: 020 7323 3770

E-mail: emma.salmon@constructionproducts.org.uk

About Barbour ABI:

Barbour ABI is a leading provider of construction intelligence services. With a team of in-house research specialists and a dedicated economics team, it provides commercially relevant insight and unique analysis of trends and developments within the building and construction industry.

Barbour ABI is the chosen provider of Construction New Orders estimates data to the Office for National Statistics, provider of the Government’s Construction and Infrastructure Pipeline and provides the planning application and development data to the Department for Communities and Local Government. Barbour ABI also provides data for independent organisations, such as the Construction Products Association.

Barbour ABI is part of global events-led marketing services and communications company, UBM, and is headquartered in Cheshire Oaks, Cheshire.

For more information, go to www.barbour-abi.com or follow on Twitter @BarbourABI for all the latest construction data news.

About the Construction Products Association:

The Construction Products Association represents the UK's manufacturers and distributors of construction products and materials. We are committed to raising the profile of our industry and members' businesses, helping grow the market and reducing regulatory risk. The sector directly provides jobs for 300,000 people across 22,000 companies and has an annual turnover of more than £55 billion. The CPA is the leading voice to promote and campaign for this vital UK industry.

The CPA produces a range of economic reports including the quarterly Construction Industry Forecasts, Construction Trade Surveys and the State of Trade Surveys. All are available to members or subscribers via our website.

Much of the CPA's work is focused on serving as the first point of contact for politicians and policy makers requiring advice and information about matters that affect construction products or the wider construction industry. This includes understanding the need for investment into manufacturing or the built environment, new housing and energy-saving retrofitting of the existing housing stock; helping to develop effective, UK and EU legislation, regulations and product standards; and promoting the role of manufacturers in delivering a resource efficient built environment.

Follow the Construction Products Association on Twitter: twitter.com/CPA_Tweets.