Summer 2016 Scenarios – Rail Infrastructure Outlook

Infrastructure forms the third pillar of the UK construction industry. Unlike other sectors – private housing and commercial, chiefly – the sector appears to have limited exposure to the implications of the Referendum outcome and uncertainty created by it. This is especially true when you consider the near-term outlook, given that the UK has still yet to invoke Article 50, which once triggered will open a two-year window for negotiating withdrawal terms. There are also widespread concerns that this could be delayed further. In the meantime, the UK still remains a member of the EU and has access to the single market.

The sector may be affected though, as the major influence on activity comes from domestic British politics. Major projects, including HS2 and Hinkley Point C, are typical catalysts behind several political debates and have been shown to be high up on the new government’s agenda (with Hinkley still a big post-Referendum talking point).

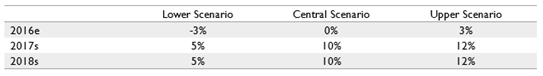

The UK undoubtedly suffered a major political shock immediately after the EU Referendum that saw a new Prime Minister step in and a Cabinet reshuffle, which to everyone’s surprise occurred rather swiftly. This may sound all good, but what about its impact on current projects? And future investments? Here we take a look at our expectations for the rail sub-sector over the next three years under three scenarios (Figure 1).

Figure 1: Rail infrastructure scenarios (% growth)

Little changed under the central scenario…

…compared to our Spring Forecast 2016. In the short-term, growth is expected to remain flat for rail output before returning to growth and increasing by 10% in both 2017 and 2018, unchanged from our previously published forecast.

The main reason behind the CPA’s short-term estimation of no growth stems from the limited work in current project pipeline for this year. This doesn’t come as a surprise given that recent years have seen work peak on major rail projects such as Crossrail, which has now reached 75% completion. The remaining 25% mainly involves architectural fit-outs of 10 new stations as well as transformation and upgrading of other stations, which is expected to be ready in time for the launch of the new service in 2018. Crossrail has often been praised and cited as an example of good project management that is being delivered on time and to budget. This is also the case with the Thames Tideway Tunnel. Although such projects have set the standards of delivery, are we likely to see upcoming projects such as HS2 follow suit?

Main civil engineering works on Phase 1 (London to Birmingham) of HS2 have been pushed back from 2017 to 2018, delaying delivery of the project by one year, with the completion date now pencilled in for 2026. The project timetable has widely been deemed as ‘unrealistic’ and according to a report by the National Audit Office (NAO), the project is also running over-budget.

HS2 has indeed encountered criticism, even more so after a report by May and Taylor (2016) revealed that the total project cost is five times more than the cost of a similar project in France – the Tours-Bordeaux high-speed rail (also known as the LGV Sud Europe Atlantique). The total cost of HS2 is estimated at £55.7bn (entirely capital funded), with an expected cost of £105m per route-km. The LGV line, which is currently under construction is costing €7.8bn ($10.06bn); that is, £20m per kilometre. Furthermore, HS2’s construction timetable assumes nine years of work (after taking into account the one year delay), whilst the French line will be delivered under six years. It has, however, been pointed out that the projects are not comparable, particularly because HS2 involves construction of new stations. Whilst debates over the highly controversial project will continue, further delays cannot be ruled out. Nevertheless, assuming that HS2 will stick to its new timetable, we anticipate robust growth rates for rail activity in both 2017 and 2018.

Also, construction on the Northern Line extension to Battersea is currently underway with main tunnelling works scheduled to start in 2017. This, alongside construction on the London Overground extension to Barking Riverside and electrification work of cross-country routes, including the Great Western and North West lines, will support growth prospects for the sub-sector.

Other scenarios – lower or higher growth rates?

In the lower scenario, we assume that rail output contracts by 3% in 2016 before returning to growth and increasing by 5% in 2017 and 2018. This assumes a higher degree of uncertainty and reduced public spending that will lead to delays in decision-making and possibly halt major projects including HS2. Following the outcome of the Referendum, Sir Amyas Morse, the chief auditor of the National Audit Office (NAO), already signalled that key projects may be reassessed, with HS2 certainly part of this list. Given that the project is already under financial strain in its early stages, this doesn’t come as surprise and the re-examining process will only push construction works outside the period covered by our scenarios.

Another risk to consider – although this is highly likely to play out in the longer-term – stems from any potential restrictions to labour mobility. Whilst we will only know the changes to labour rules as negotiations with the EU progress, uncertainty may deter migrating workers in the near-term. This will only exacerbate the construction industry’s skills shortage problem and, in turn, fuel higher labour and construction costs that will eventually translate into project delays.

The lower growth rates anticipated in the lower scenario can be avoided if Network Rail brings forward finance from later years of Control Period 5 (2014/15 to 2018/19). This will allow work to get off the ground or avert any potential slowdown in electrification work, especially in the near-term. With this forming the basis of our upper scenario, we anticipate rail activity to grow 3% in 2016 followed 12% in 2017 and 2018.

Whether we should brace ourselves for an upper, lower or central scenario all remains unclear as yet. The ramifications of the Referendum outcome on infrastructure are indeed wide-ranging and are yet to be fully seen. For now, domestic politics holds the key to major projects going ahead – which are vital to ensuring growth maintains its momentum.