Forecasting for any sector first requires a base or underlying assumption to be made about the path for general economic conditions. Coronavirus has made this much more difficult than in ‘normal’ times due to the unprecedented nature of the pandemic and fast-changing policy responses.

Since the initial lockdown in March, we have based our main scenario on the assumption that the economic recovery would be tick-shaped, meaning that as restrictions were eased from mid-May, the reopening of the economy and construction drives the initial phase of strong growth, as we saw in Q3. The pace then would be assumed to slow in Q4 as unemployment, previously protected through the job retention scheme, starts to rise. In common with most forecasters, this recovery profile means the economy doesn’t return to its pre-coronavirus level until the beginning of 2022.

Key to this scenario was that it took into account the shift in policy towards tighter restrictions implemented on a local or regional basis, which generally aimed to restrict social interactions rather than economic activity.

Running alongside the tick-shape assumptions, there has always been the possibility of a ‘second wave’ of coronavirus infections in Winter that necessitates, once again, tighter nationwide restrictions. Saturday’s announcement from the Prime Minister of a return to a lockdown in England (along with the two-week ‘firebreak’ in Wales and the five-level scale in Scotland), therefore, aligns what’s going on more closely to our alternative W-shaped scenario.

Similarly diagrammatic in terms of what it means for the economy, UK GDP is likely to see a second dip in Q4 as large parts of the services sector pause or reduce activity this month. A degree of learning experience from April, as well as the continuation of education, mean that this contraction will not be as severe as the 19.8% decline in Q2. This is particularly the case for product manufacturing and construction, which are both unequivocally allowed to continue and have been successfully operating under social distancing procedures for the past few months.

For construction the effects will be on near-term demand and confidence in Q4 and 2021 Q1. This is particularly the case if hard-hit services businesses have to turn to redundancies, pushing unemployment higher over the next six months and fuelling an economy-wide notion of lower job security, in turn reducing discretionary spending and/or increasing precautionary saving.

Meanwhile, businesses are likely to hold off on investment over this period, notably into commercial premises like new offices and retail space until the picture on demand becomes clearer.

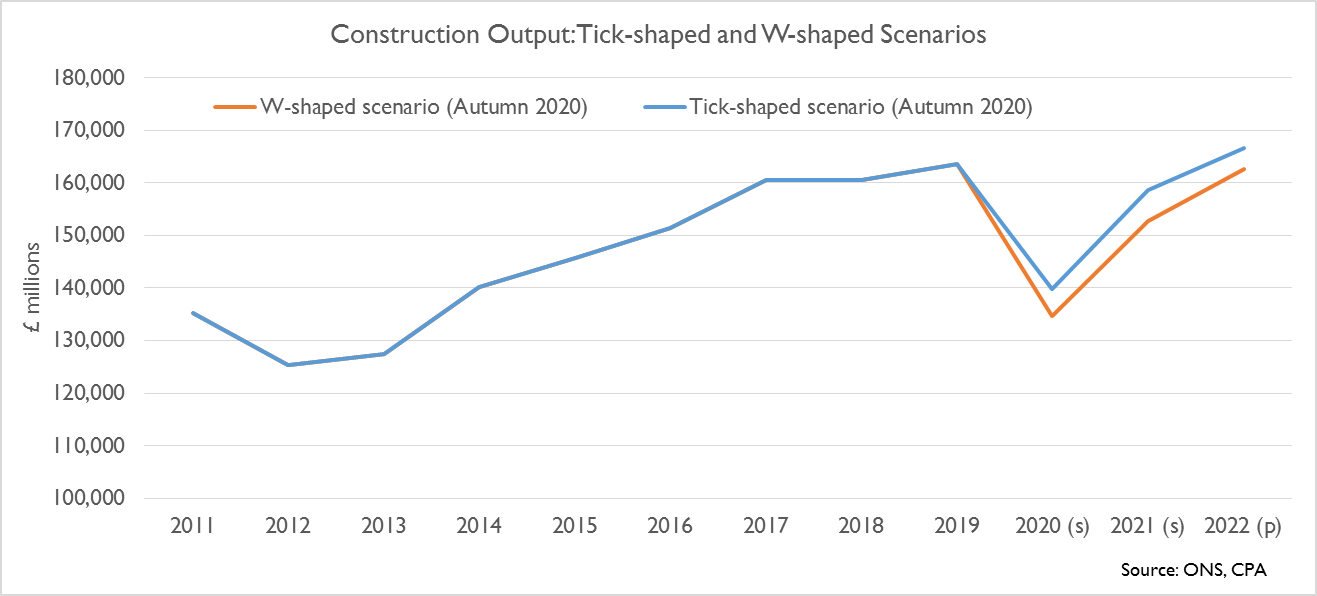

It is this slower decision-making and weaker consumer demand that is likely to apply the brakes on construction, rather than the lockdown itself. Based on our Autumn Scenarios, the chart below shows the difference in levels of construction output in 2020, 2021 and 2022 between the tick-shaped profile and the W-shaped scenario, which puts levels of activity 3.8% lower in 2021 in the W-shape. But in fact, given the low restrictions that will be placed on construction and the housing market this time around, it’s actually more likely that the economy will follow the W-shape path and construction will sit somewhere between the tick-shape and the W-shape. A full breakdown by sector of both the tick-shaped and W-shaped scenarios is available in our Autumn Scenarios publication.