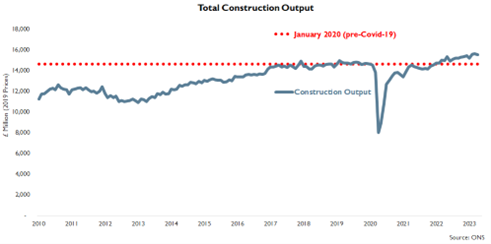

Construction output volume in April 2023 (0.6%) was lower than in March, higher (3.6%) than a year ago and higher (6.0%) than in January 2020 pre-pandemic. According to the ONS with firms in the construction supply chain state that overall April was lower (and significantly lower than expected) after growth in February & March, whilst May showed a pickup in activity despite additional bank holiday.

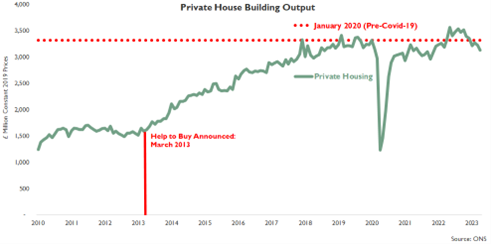

Output in private housing new build (the largest construction sector) in April 2023 was lower (3.0%) than in March (5.8%) lower than a year ago and lower (5.7%) than at the pre-pandemic January 2020 level. Output in private housing new build in April 2023 was also lower (12.1%) than at the recent peak in May 2022, before the Truss-Kwarteng Mini-Budget debacle and consequent mortgage rate rise. However, it is worth noting that private housing still hasn't seen the full impact of the sharp fall (30-40%) in housing demand in 2022 Q4 and the subdued level of demand in 2023 Q1. This is due to house builders still focused on completing existing developments. The fall (49%) in housing registrations in 2023 Q1 compared with a year earlier, according to NHBC, has not fed through to activity or rather a lack of activity, down on the ground. In addition, a recent sharp rise in markets’ expectations of interest and mortgage rates will dampen housing demand. This will make house builders more risk-averse to starting new developments, leading to further falls in activity in 2023 H2.

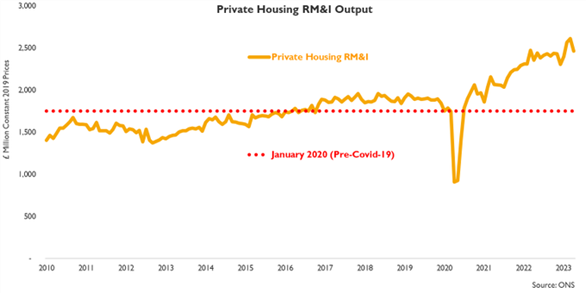

Private housing repair, maintenance & improvement (rm&i) is now the 2nd largest construction sector according to the ONS (although the ONS data appear to have deflator issues, so it appears to be overestimating the volume of activity in the sector). Private housing rm&i output in April 2023 was lower (5.7%) than in March (note: March was its highest-ever level on record according to the ONS) but it was higher (4.6%) than a year earlier. However, firms in private housing rm&i state that activity fell away from a peak in March last year & although activity so far this year is higher than in the subdued 2022 Q4, activity is considerably lower than a year ago and lower than the ONS reports.

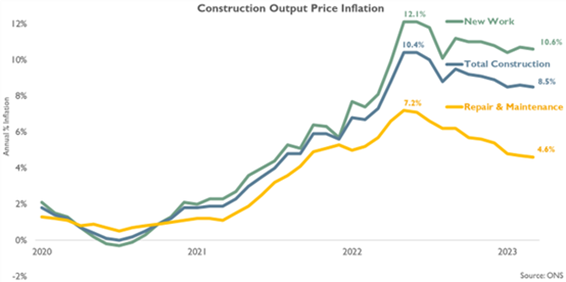

The ONS's apparent issue with estimating the volume of repair & maintenance appears to be that has been underestimating construction price inflation (that it uses to turn the value of construction output into volume) for r&m. It has been an issue since energy and commodity price spikes after Russia’s invasion of Ukraine last year (2022). The ONS estimated r&m price inflation peaked in May 2022 (7.2%) whilst firms in r&m stated that it peaked at more than double. As the ONS appears to be underestimating construction price inflation, consequently, it appears to have been overestimating the volume of output since the energy and commodity price spikes in 2022 Q2.

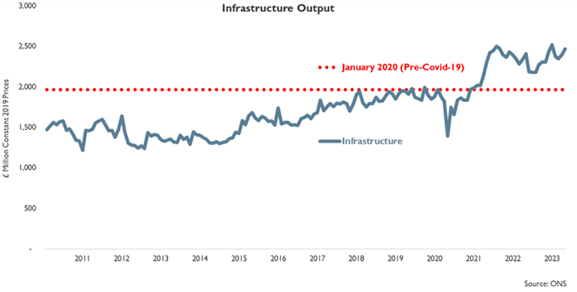

Infrastructure output in April 2023 was higher (2.9%) than in March (2.4%) than a year earlier and higher (25.5%) than in January 2020, because of major projects including HS2, Hinkley Point C, Thames Tideway. This was also due to work on long-term frameworks in regulated sectors (rail, water, roads, energy etc.) from projects signed up to and started in previous years, however, cost inflation means projects going well over budget.

Going forward, projects already down on the ground will continue, but government delays to new road projects and HS2 work stopping at Euston station and in Staffordshire will affect activity in 2023 and 2024. In addition, client hesitancy in signing off on projects, given budgetary constraints and concern over cost inflation will adversely affect output in infrastructure. Having said that, activity remains at a high level overall.

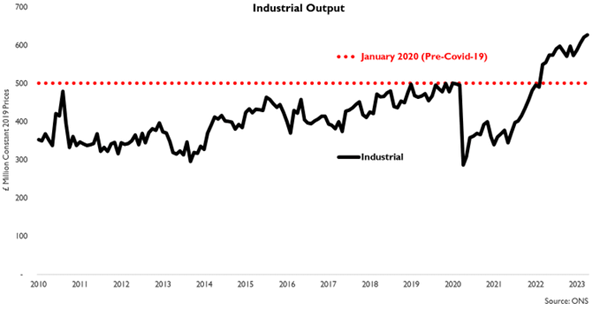

Industrial output in April 2023 was higher (1.0%) than in March, higher (13.0%) than a year ago and at its highest level on record again, driven by very strong warehouses & factories activity. Industrial output in April 2023 was also higher (25.1%) than in January 2020, pre-pandemic and it is likely to continue to remain strong in 2023 Q2 & Q3.

However, industrial activity appears to be about to plateau. The new investment market for warehouses has now peaked, so after current projects have been built, warehouse activity is likely to fall away - albeit from historic high levels.

Strong current factories activity is based on investment decisions signed off in Autumn 2021 to expand existing factories or build new facilities, which coincides with strong demand and manufacturers were capacity constrained. Manufacturing investment decisions in Autumn 2022, however, could not be signed off due to economic and political instability after the Mini-Budget, so factories' output is likely to fall over the next 12 months after current projects finish.

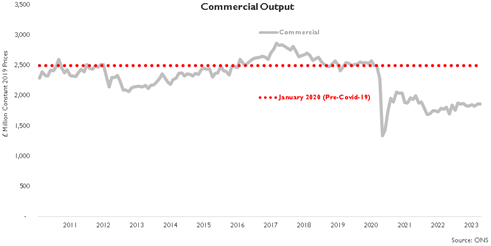

Commercial output in April 2023 was lower (1.8%) than in March but 7.5% higher than a year ago. It’s important to note that April 2022 was a particularly low figure compared with output figures in the other months of last year, whilst commercial output in April 2023 was still lower (27.0%) than pre-pandemic.

Firms working on high-end refurbishment & fit-out of existing developments report activity is considerably higher than pre-pandemic. Also, demand for grade A quality office space is strong from tenants downsizing and with an excess of existing floor space lower than grade A. This lends itself towards refurbishment & fit-out activity, particularly from commercial owners that will need to refurbish existing developments.

Most of the commercial sector is based on new towers, where activity remains lower (25%) than pre-pandemic. There are a few new towers in the pipeline but a fraction of those are being built pre-pandemic as new build towers are disproportionately affected by concerns over demand for new office space. This comes as a result of an excess of existing space, cost inflation issues & interest rates that will affect financing costs.

To keep up-to-date with the latest economic data, you can follow our Economics Director Noble Francis on his Twitter page.

Why not also follow the CPA Twitter page for the latest movements in the built environment?